Top 10 Percent Net Worth By Age

Top 10 Percent Net Worth by Age - What It Means for You

Thinking about your money situation, it's pretty natural to wonder how you stack up against others. People often talk about financial goals, and sometimes, you might hear about what it takes to be among the financially well-off. There is, you know, a group of people who have built up quite a bit of wealth, and looking at what they have at different points in their lives can be a way to think about your own path.

So, when we talk about the "top 10 percent net worth by age," we are really just looking at what a person owns versus what they owe, compared to others who are around the same number of years old. It is, in a way, like seeing where you stand on a sort of financial ladder, specifically for your age group. This idea helps us understand that financial standing often changes as people get older, what with more time to save or maybe even pick up some things that hold value.

This kind of information can feel a bit like a secret club, but it is actually just data that helps us see trends. It can be helpful for anyone who is curious about how finances tend to grow or change over a person's life. We will, in fact, go over some general ideas about what this means and how people tend to get there, giving you a clearer picture of what the numbers might suggest.

Table of Contents

- What Does "Top 10 Percent Net Worth by Age" Really Mean for You?

- How Do People Get Into the Top 10 Percent Net Worth by Age?

- What Does Your Net Worth Look Like at Different Ages?

- Understanding the Top 10 Percent Net Worth by Age in Your Twenties

- The Path to Top 10 Percent Net Worth by Age in Your Thirties and Forties

- Is Reaching the Top 10 Percent Net Worth by Age Possible for Everyone?

- Where Can You Find Information About Top 10 Percent Net Worth by Age?

What Does "Top 10 Percent Net Worth by Age" Really Mean for You?

When we talk about someone's financial standing, a really simple way to look at it is to think about their net worth. This is, basically, all the things you own that have some kind of value, like money in the bank, a house, or perhaps a car, minus all the money you owe other people, like student loans, car payments, or credit card bills. It is, you know, a snapshot of your financial picture at a certain point in time.

So, if someone has a lot of valuable things and does not owe much, their net worth will be higher. If they owe more than what their things are worth, their net worth might be lower, maybe even below zero. This number, in fact, gives us a general idea of how much financial freedom a person might have.

Now, when we add "top 10 percent" to that, it means we are looking at the people who have a higher net worth than 90 out of every 100 people in their age group. It is, sort of, like being among the top performers in a class, but for money. This is not about how much money someone makes each year, but rather how much they have saved up and built up over time.

Why is age so important here? Well, it is pretty simple, actually. A person just starting out in their working life, maybe in their early twenties, usually has not had much time to save money or buy big things like a house. They might also have a lot of school debt. So, their net worth would typically be lower than someone who has been working for 30 or 40 years. This is why comparing yourself to people who are about your age makes more sense.

It is, in some respects, like comparing apples to apples. You would not expect a five-year-old to run as fast as a grown-up, right? Similarly, you would not expect someone fresh out of college to have the same amount of financial security as someone nearing the end of their working years. This age part really helps put things into perspective and makes the numbers more meaningful for individuals.

The numbers themselves change all the time, of course, because of things like how much things cost, how much money people make, and how much debt people tend to have. But the idea of the top 10 percent net worth by age remains a way to see how wealth is spread out among people of similar ages. It is, you know, a way to measure financial progress for many.

How Do People Get Into the Top 10 Percent Net Worth by Age?

People who reach the higher levels of financial standing often do a few key things over a long period of time. It is not usually about winning the lottery or getting a sudden, huge amount of money, though those things can happen for some. Instead, it is more about making steady choices with money, year after year. This is, typically, a long-term project.

One very important thing is saving money on a regular basis. This means putting aside a part of the money you earn, rather than spending it all. It could be a small amount at first, but over time, these small amounts can add up to something quite big. This is, you know, like filling a jar with coins; eventually, it gets full.

Another part of it is making smart choices about spending. This does not mean never enjoying life or always being super strict with money. It just means being thoughtful about where your money goes. For example, maybe you choose to live in a place that costs a little less, or you try to find good deals on things you need. This, in a way, leaves more money free to save or put toward other things.

Then there is the idea of making your money grow for you. This often involves putting money into things that can increase in value over time, like certain kinds of savings accounts or even buying a piece of property. It is, kind of, like planting a seed and watching it become a plant. Your money can, in fact, grow if you give it time and the right conditions.

For many, this means learning a little bit about how money works and what options are out there for making it increase. It is not about being a financial expert, but rather having a basic grasp of how to make your money work harder for you. This is, basically, a step-by-step process that many people follow.

Some people also find ways to make more money, perhaps by getting a higher-paying job, starting their own small business, or learning new skills that are in demand. This can, of course, give them more money to save and put toward their financial goals. It is, you know, like adding more water to that jar of coins, making it fill up faster.

What Does Your Net Worth Look Like at Different Ages?

It is pretty clear that your financial picture tends to change a lot as you get older. What counts as a good amount of money for someone in their twenties is often very different from what it means for someone in their fifties. This is, very much, a natural part of life and building up financial standing over time.

When people are younger, say in their twenties, they might be just starting their careers. They could be paying off school loans or just figuring out how to manage their first real income. It is, you know, a time when many people might have a lower net worth, or even a negative one, because of debts. This is, typically, a period of building and learning.

As people move into their thirties and forties, they often start to earn more money, and they might begin to save more seriously. They might buy a home, which can be a big part of their net worth. This is, actually, a time when many people see their financial standing start to grow at a faster pace. They are, in a way, hitting their stride.

By the time people reach their fifties and sixties, they have usually had many years to save and invest. Their homes might be paid off, or nearly so, and their savings could have grown quite a bit. This is often the time when people have their highest net worth, as they are getting ready for a time when they might not be working as much. It is, sort of, the peak of their financial journey.

These are, of course, just general patterns. Everyone's situation is a little different, depending on their job, where they live, and the choices they make. But these age groups give us a helpful way to think about how financial standing tends to build up over a lifetime. It is, you know, a gradual process for most.

Understanding the Top 10 Percent Net Worth by Age in Your Twenties

For people in their twenties, reaching the top 10 percent net worth by age might seem like a very big mountain to climb. Many young people are just getting their feet wet in the working world. They might be dealing with student loan payments, or maybe trying to save up for a first home. So, their net worth numbers can often be on the lower side, or even negative because of debts. It is, basically, a time of setting up the foundation.

To be in the top 10 percent net worth by age at this stage often means having very little debt, or perhaps having received some financial help, or starting a business that took off quickly. It could also mean being very good at saving money from a young age. This is, in fact, a period where even a small amount of savings can make a difference in where you stand compared to others your age. It is, you know, about getting an early start.

The focus for many in their twenties is usually on building skills, gaining experience in their jobs, and maybe paying down some of those initial debts. Thinking about the top 10 percent net worth by age at this point is more about building good money habits that will help in the long run, rather than hitting a specific number right away. It is, sort of, like training for a long race.

The Path to Top 10 Percent Net Worth by Age in Your Thirties and Forties

As people move into their thirties and forties, the picture for the top 10 percent net worth by age starts to shift quite a bit. This is often a time when careers are more established, and incomes might be higher. Many people are also buying homes, which, as we know, can be a big part of their overall financial standing. This is, in a way, where things really start to take shape.

To be among the top 10 percent net worth by age in these middle years, people typically have a good handle on their spending and are consistently putting money away. They might be putting money into savings accounts that grow over time, or paying down their home loans. They are, you know, actively working to increase their valuable things and reduce what they owe. It is, quite often, a period of steady growth.

Some people in this group might have started their own successful businesses, or they could have jobs that pay very well. They are, perhaps, making smart choices about where they live and how they spend their money, allowing them to save more. This is, actually, where the compounding effect of savings and good choices really begins to show. It is, basically, about making your money work for you over many years.

Is Reaching the Top 10 Percent Net Worth by Age Possible for Everyone?

The idea of getting into the top 10 percent net worth by age is, for many, a goal that takes a lot of effort and good choices. It is, however, important to remember that everyone starts from a different place, and everyone has their own set of life circumstances. So, while it is a goal that many can work towards, it might not be a realistic outcome for absolutely everyone. This is, you know, a complex topic with many parts.

Things like how much money you earn from your job, how much things cost where you live, and even unexpected life events can all play a big part in your financial journey. Someone who has a very high income and low living costs might find it easier to save a lot of money. On the other hand, someone with a lower income or very high expenses, perhaps due to family needs, might find it much harder. It is, in some respects, about the hand you are dealt and how you play it.

Also, the choices people make with their money matter a lot. Deciding to save a part of your income, choosing not to take on too much debt, and learning about ways to make your money grow can all help. These choices, over many years, can really add up. This is, basically, about consistent effort.

So, while the top 10 percent net worth by age is a measure of financial standing, it is not the only way to think about a good financial life. For some, being financially secure and comfortable, without a lot of money worries, is a more important goal than hitting a specific top percentage. It is, sort of, about what feels right for you.

The main thing is to set your own financial goals that make sense for your life and what you want to achieve. Whether that means aiming for the top 10 percent net worth by age or simply building a comfortable life for yourself and your loved ones, it is about making thoughtful choices with your money. This is, you know, a very personal path.

Where Can You Find Information About Top 10 Percent Net Worth by Age?

If you are curious about the specific numbers for the top 10 percent net worth by age, there are places where you can find general information. Government groups that collect data on how people are doing financially often put out reports. These reports might give you an idea of what typical financial standing looks like across different age groups. This is, typically, where many people look for this kind of information.

For example, in the United States, the Federal Reserve, which is a big financial organization, does surveys about how much money families have and what they owe. They collect a lot of information from people across the country. These surveys, you know, give a broad picture of financial well-being. This is, in fact, a really good place to start if you are looking for general trends.

There are also many financial websites and articles that talk about these kinds of numbers. They often take the data from these big surveys and explain what it means in simpler terms. You can, in a way, find a lot of discussion about financial standing and what it takes to build wealth on these sites. It is, basically, about looking at reputable sources.

When you are looking at this kind of information, it is a good idea to remember that the numbers are averages or typical amounts. Your own situation might be different, and that is perfectly fine. These numbers are more like a guide to general trends, rather than a strict rule for everyone. This is, sort of, like looking at the average height of people; not everyone will be that exact height.

It is also worth noting that these numbers can change over time. What was considered a high net worth a few years ago might be different today, because of changes in how much things cost or how much money people earn. So, if you are looking up this kind of information, it is a good idea to make sure it is fairly recent. This is, you know, about getting the most current picture.

Finding Reliable Data on Top 10 Percent Net Worth by Age

When you are trying to find good, solid information about the top 10 percent net worth by age, it is pretty important to know where to look. You want sources that collect their information carefully and present it clearly. This is, you know, about getting the real picture.

Think about looking for reports from government groups that focus on money and numbers. They often have big teams that gather information from many people, so their numbers tend to be quite broad and cover a lot of different situations. This is, in fact, a good way to get a general idea.

Also, some universities or research groups that study money matters might publish their findings. These places often look very closely at the numbers and explain what they mean. They can give you a deeper understanding of how financial standing changes for people at different points in their lives. It is, basically, about finding trusted voices.

Be a little careful with information you find on just any website, as some might not be using the most up-to-date or complete numbers. It is always a good idea to check if the source is known for being accurate and if they say where their information comes from. This is, sort of, like checking the ingredients list on a food package.

The goal is to get a general sense of the financial picture for different age groups, not to find an exact number that applies to every single person. These numbers are, you know, averages and ranges, which can still be very helpful for understanding broad trends in financial standing. It is, in some respects, about

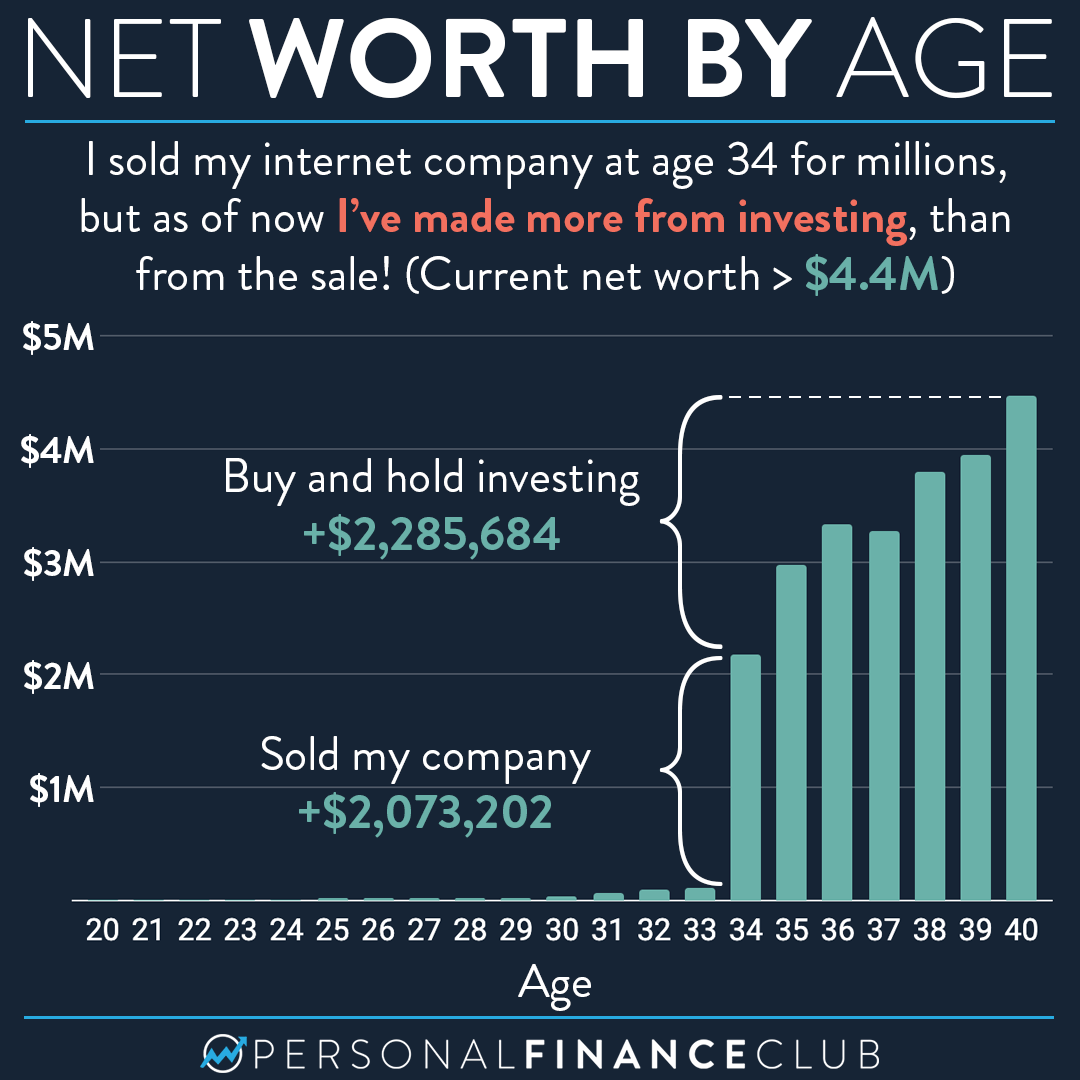

I’m a millionaire and this is my net worth by age – Personal Finance Club

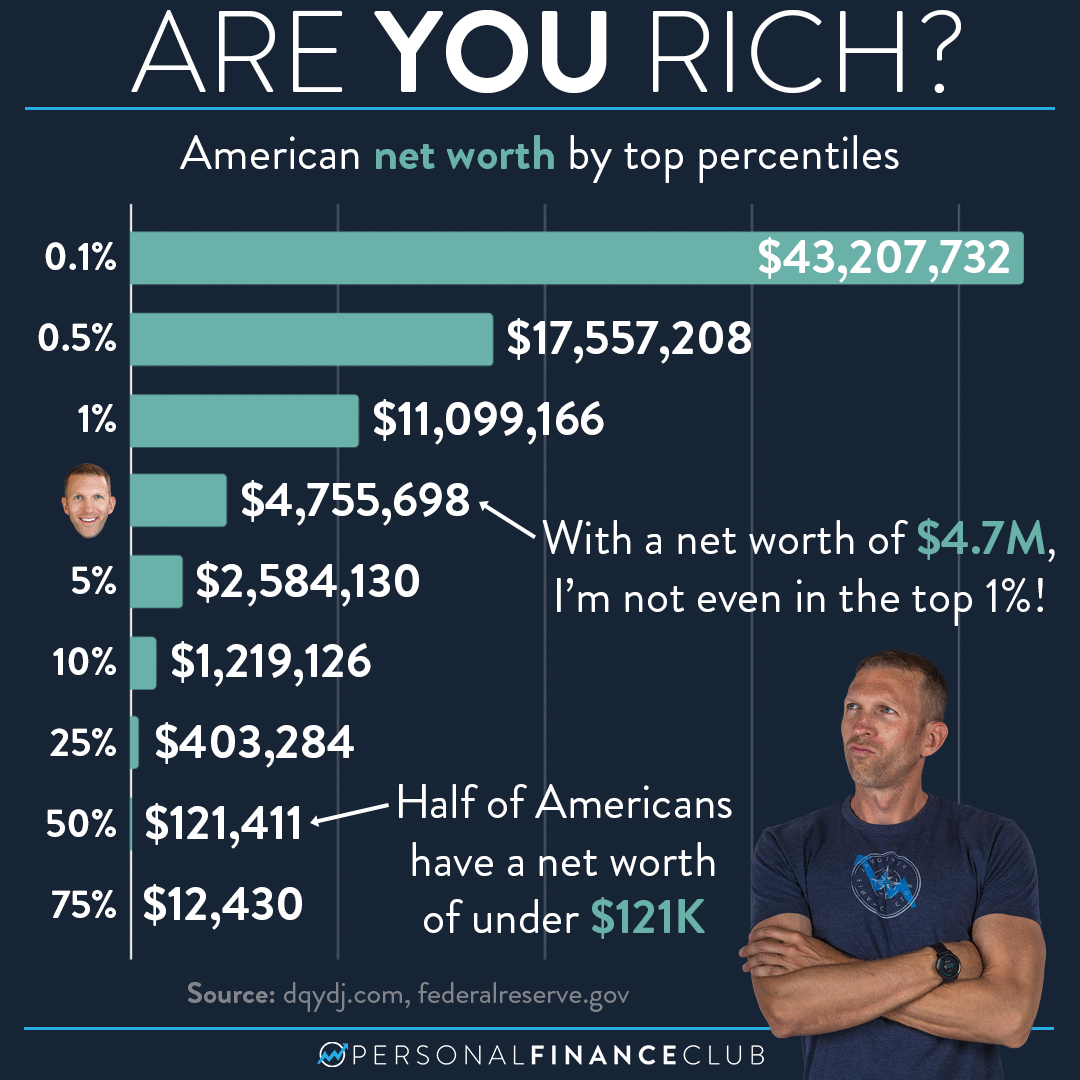

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

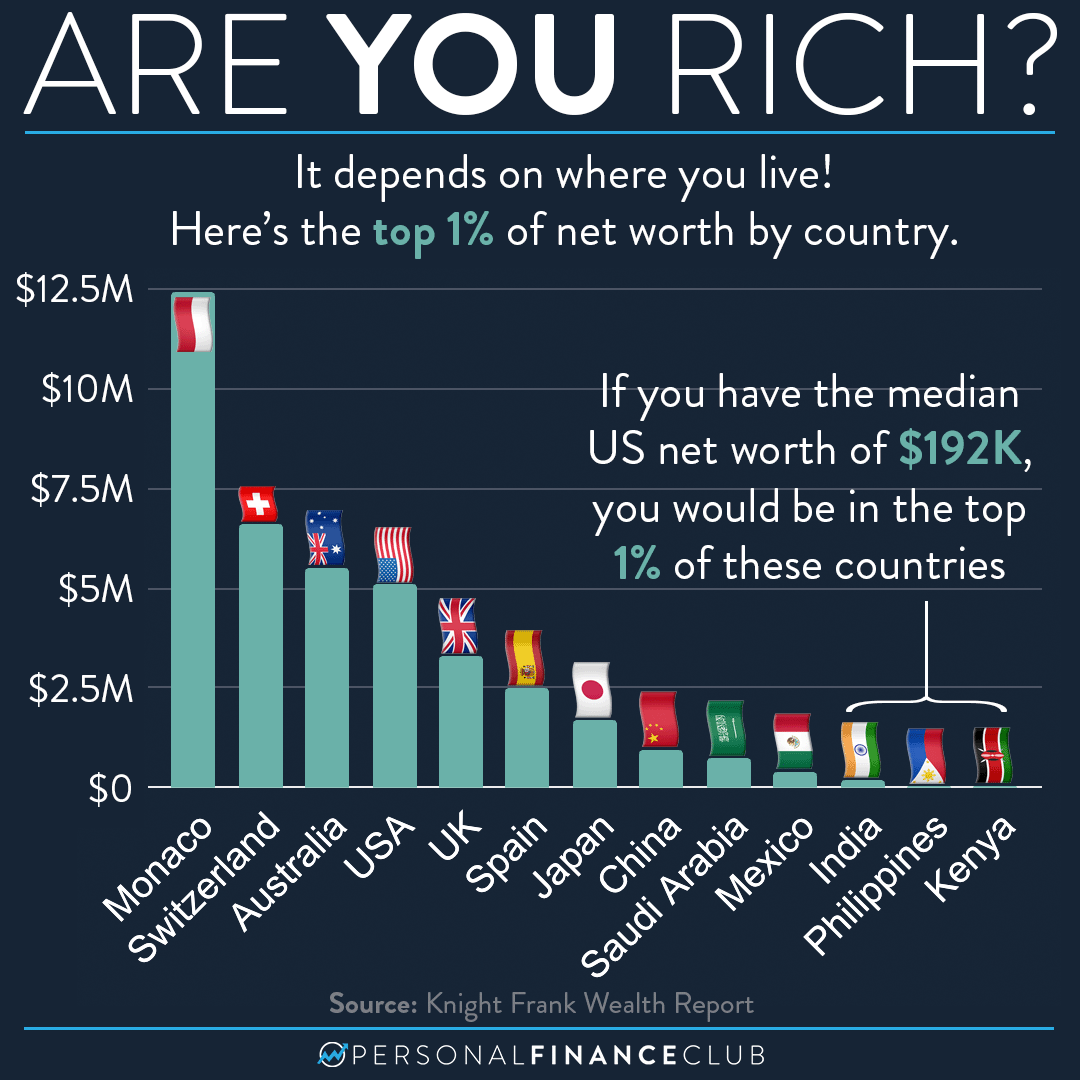

What is the top 1% of net worth by country? – Personal Finance Club