Top 5 Percent Net Worth By Age - What It Means

It's quite natural, you know, to wonder where you stand financially compared to others. Many people, it seems, have a curious thought about their money matters, especially when they think about their age and what others around them might have saved up or own. We often hear talk about the "top earners" or those with a lot of money, and it can feel a bit distant, like something for a different group of people. But what does it actually mean to be in that very specific group, say, the top 5 percent when we consider how old someone is?

This kind of thinking, you see, isn't about judging or feeling bad; it's more about having a clearer picture of the financial landscape. It’s about understanding the different levels of wealth that people build up over their lives. Knowing what it takes to be among the financially well-off for your age group can offer a different way to look at your own money plans, or just satisfy a bit of curiosity about how things generally work out for folks.

So, we're going to take a closer look at what it means to be in that top tier of wealth, specifically the top 5 percent, and how that picture changes as people get older. We'll explore what these numbers actually represent and where some of this information comes from, like official surveys. It's really just about getting a better sense of what these financial benchmarks look like for people at different points in their lives, and perhaps, what might play a part in getting there.

Table of Contents

- What Does "Top 5 Percent Net Worth by Age" Really Indicate?

- How Do We Figure Out the Top 5 Percent Net Worth by Age?

- What Do the Numbers Show for Top 5 Percent Net Worth by Age?

- Is There a Link Between Income and Top 5 Percent Net Worth by Age?

- What Do the Federal Reserve Surveys Tell Us About Top 5 Percent Net Worth by Age?

- Can a Net Worth Calculator Help You with Top 5 Percent Net Worth by Age?

- Thinking About Your Financial Standing and Top 5 Percent Net Worth by Age

What Does "Top 5 Percent Net Worth by Age" Really Indicate?

When we talk about "net worth," we are, in a way, looking at a person's complete financial picture. It's essentially what you own minus what you owe. So, if you add up the value of your house, your savings, your investments, and anything else that has a cash value, and then you take away things like your mortgage, student loans, or credit card bills, what's left over is your net worth. It’s a pretty simple calculation, but it tells a big story about someone's financial standing. Now, when we bring "top 5 percent" into the discussion, we are narrowing that focus considerably. It means we are looking at the households that have managed to gather more wealth than 95 out of every 100 other households. It's a rather small group, you know, at the very top of the wealth pile.

The "by age" part of this phrase is really important, too. It makes sense that someone who has been working and saving for many years might have accumulated more wealth than someone just starting out. A person in their sixties, for example, has had a lot more time to build up assets and pay down debts than someone in their twenties. So, when we talk about the top 5 percent net worth by age, we are comparing people to others who are roughly in the same stage of life. This helps make the comparison fair and more meaningful, because, really, it would be a bit silly to compare a fresh graduate's wealth to that of someone nearing retirement, wouldn't it? It’s about seeing how people are doing within their own generation, which is, in some respects, a more useful way to think about it.

This measurement of the top 5 percent net worth by age isn't just about having a high income, either. While a good income certainly helps, net worth is also about how well someone manages their money over time. It involves making choices about saving, investing, and how much to spend. Some people might earn a lot but spend it all, so their net worth might not be as high as you'd think. Others might have a more modest income but are very good at saving and investing, allowing their wealth to grow steadily. So, it's a mix of earning capacity and, you know, smart financial habits that really puts someone in that top group for their age.

How Do We Figure Out the Top 5 Percent Net Worth by Age?

You might be wondering how we even get these numbers for the top 5 percent net worth by age. It’s not like everyone just publishes their financial details for the world to see, right? Well, the information often comes from very large, official surveys. For example, the Federal Reserve, which is the central bank of the United States, conducts a survey called the Survey of Consumer Finances. They gather a lot of data from many different households across the country. This survey is designed to get a good picture of what people own, what they owe, and their overall financial health. It’s a pretty big undertaking, as a matter of fact, to collect all that information accurately.

When these surveys are done, the people who analyze the data can then sort it out in many ways. They can look at all households together, or they can break it down by different groups, such as by age. This allows them to see, for instance, what the total wealth is for the oldest age groups versus the youngest ones. They can then calculate what it takes to be in the top 5 percent of wealth for each of those age brackets. So, you know, they can tell us that for people in their thirties, a certain amount of net worth puts them in that top tier, and for people in their fifties, a different, probably higher, amount is needed. It’s all based on these detailed studies that try to capture a true snapshot of financial life for regular people.

The numbers from these surveys are, basically, estimates. They give us a good idea of general trends and what typical wealth levels look like for different groups. While they don't tell us about every single person, they provide a strong statistical picture. This kind of information is quite helpful for economists and policymakers, but it’s also, you know, pretty interesting for anyone who wants to get a sense of where they stand or what financial goals might look like at different life stages. It helps to set a kind of benchmark, a point of reference, for thinking about wealth accumulation across various age groups, which is really what this idea of the top 5 percent net worth by age is all about.

What Do the Numbers Show for Top 5 Percent Net Worth by Age?

Let's get into some of the actual figures that help define what it means to be in the top 5 percent net worth by age. While these numbers can shift over time due to various economic changes, some projections give us a good idea of the scale we're talking about. For example, some predictions for 2025 suggest that to be in the top 5 percent of net worth generally, a household would need to have around $1.17 million. That's a pretty substantial sum of money, you know, a significant amount of assets after all debts are accounted for. It really shows the kind of financial strength that group possesses.

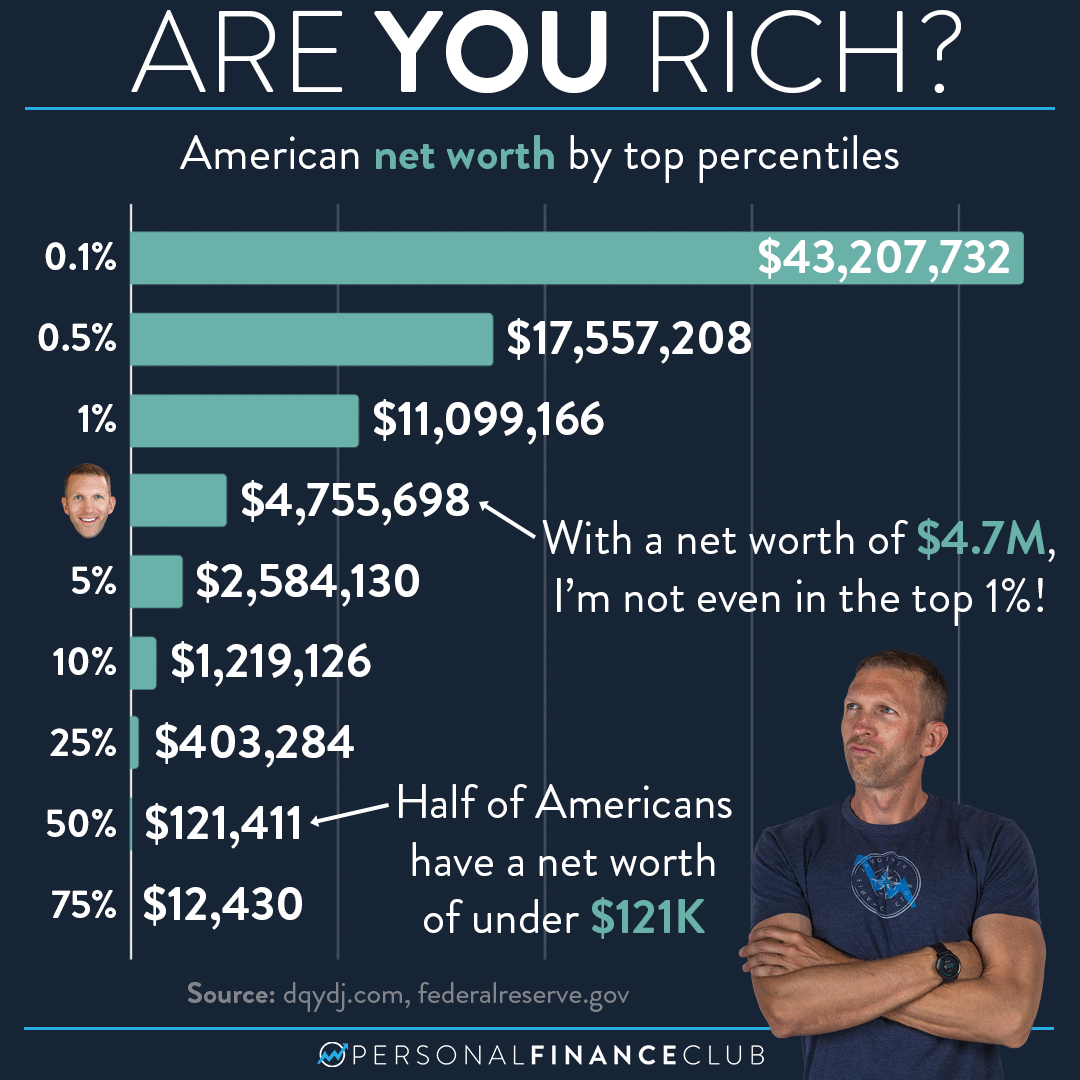

And it gets even higher as you move up the financial ladder. For those in the top 2 percent, the suggested net worth for 2025 jumps to about $2.7 million. Then, for the very top, the elite 1 percent, that number is projected to be a remarkable $11.6 million. These figures, you see, give us a sense of the sheer difference in wealth at the very highest levels. It's not just a little bit more; it's a lot more. These numbers are for the entire population, not specifically broken down by age here, but they set the general context for what "top tier" wealth looks like. It’s, basically, a very high bar to clear.

When we apply this thinking to the top 5 percent net worth by age, it means that for each age group, there's a specific amount that puts you in that top segment. The required net worth will typically increase as people get older, simply because they've had more time to earn, save, and invest. So, while $1.17 million might be the general benchmark for the top 5 percent, a younger person in that group would likely have a lower net worth than an older person in the same percentile for their age. It's all about the relative position within one's own age cohort, which, really, makes the comparison more fair and, you know, relevant to personal circumstances.

Is There a Link Between Income and Top 5 Percent Net Worth by Age?

It's a pretty common thought that if someone has a high net worth, they must also have a high income, and that's often true. People who earn a lot of money certainly have an easier time saving and investing a good portion of it, which can help their net worth grow faster. So, yes, there is typically a strong connection between bringing home a lot of money and being able to build up a substantial amount of wealth. If you are consistently earning a large salary or have a very successful business, it just provides more fuel for your financial engine, so to speak. This is, you know, pretty straightforward when you think about it.

However, it's also important to remember that a high income doesn't always guarantee a high net worth. Someone could be earning a huge amount but also spending just as much, or even more. If they have a very expensive lifestyle, or perhaps a lot of debt, their net worth might not be as impressive as their income suggests. On the other hand, someone with a more modest income who is very disciplined about saving, investing wisely, and avoiding unnecessary debt can, in fact, build up a very respectable net worth over time. It's about the difference between what comes in and what goes out, and what happens to the money that stays. So, you know, income is a big part of the picture, but it’s not the whole story when it comes to the top 5 percent net worth by age.

So, while looking at the top 5 percent of earners in each age group can certainly give you some idea of where you stand, it's not the only piece of the puzzle. Net worth is a more complete measure of financial health because it takes into account everything you own and everything you owe. It’s a measure of accumulated wealth, which is a different thing from just how much money flows into your bank account each month. It's, basically, the sum of all your financial decisions over the years, which is why it's such a telling figure for the top 5 percent net worth by age.

What Do the Federal Reserve Surveys Tell Us About Top 5 Percent Net Worth by Age?

The Federal Reserve's Survey of Consumer Finances is, really, a goldmine of information when we want to understand wealth across different age groups. The 2022 survey, for instance, provides some clear figures on what kind of net worth is needed to be in the top 5 percent. These numbers give us a solid benchmark. While the exact figures can vary slightly with each new survey, they consistently show how wealth tends to grow as people get older. It's, you know, a pretty predictable pattern, as most people accumulate assets over their working lives.

Looking back at the 2019 survey, we can see some interesting median net worth figures for different age groups. The "median" means the middle point; half the people in that group have more, and half have less. For those under age 35, the median net worth was about $14,000. This number, you know, reflects that many younger people are just starting out, perhaps with student loan debt or not much saved up yet. It's a common starting point for many, as a matter of fact.

As people get a bit older, say, into the 35 to 44 age range, the median net worth shows a good jump, reaching around $91,110. This increase, basically, indicates that people in this age bracket have had more time to establish careers, perhaps buy a home, and start building up their savings. Then, for those in the next age group, the median net worth was even higher, at about $168,800. These figures, you see, paint a clear picture of how wealth typically builds over a person's working life. They aren't specifically for the top 5 percent net worth by age, but they show the general trend of wealth accumulation that the top 5 percent would also follow, just at a much higher level.

Can a Net Worth Calculator Help You with Top 5 Percent Net Worth by Age?

You might be wondering if there's an easy way to see where you personally stand when it comes to the top 5 percent net worth by age. The good news is, yes, there are tools out there that can help. Many websites offer what's called a net worth percentile calculator. These tools are designed to take your current age and your household's total net worth, and then compare that information to the broader population data, often from sources like the Federal Reserve surveys we talked about. So, you know, you can punch in your numbers and get an instant idea of your standing.

These calculators are pretty simple to use. You just enter your age, or sometimes an age bracket, and then your household's total net worth. The calculator then does the work, showing you your net worth percentile rank. This means it will tell you, for example, if your household net worth is in the 50th percentile, or perhaps the 75th percentile, or even, you know, the top 5 percent or top 1 percent for your specific age group. It's a way to quickly find out where you fit into the overall financial picture, which can be, basically, quite insightful for many people.

Using such a calculator can be a helpful way to gauge your financial progress. It lets you see not just where you are now, but also where you might want to project yourself to be in the future. It’s a bit like a financial map, showing you your current location relative to others. While it’s just a tool, and the numbers are based on broad data, it does offer a quick and easy way to understand your position within the context of the top 5 percent net worth by age, and all the way up to the very highest wealth percentiles in the United States. It's a neat way, really, to put things into perspective.

Thinking About Your Financial Standing and Top 5 Percent Net Worth by Age

When we look at numbers like the top 5 percent net worth by age, it's easy to get caught up in the figures themselves. But, you know, it’s also a good chance to think more broadly about what financial well-being means for you. These benchmarks are interesting, and they show what a certain level of accumulated wealth looks like at different points in life. They can give us a general idea of what's possible, or what some people have managed to achieve. However, everyone's financial journey is, basically, unique, and what matters most is often personal comfort and security, rather than just hitting a specific percentile.

The idea of being in the top 5 percent net worth by age can serve as a kind of aspirational goal for some, or just a point of comparison for others. It highlights the importance of consistent saving, smart spending choices, and making good decisions with investments over time. It’s a reminder that wealth isn't usually built overnight; it's the result of many small and large financial steps taken over many years. So, you know, it's a marathon, not a sprint, when it comes to building up significant wealth.

Ultimately, whether your net worth places you in the top 5 percent for your age group, or somewhere else, the main thing is to feel good about your own financial situation. It’s about having enough to meet your needs, pursue your goals, and feel secure about the future. These figures for the top 5 percent net worth by age just offer a window into how wealth is distributed across different generations, giving us a clearer picture of the financial landscape that people are navigating in their lives, which is, really, quite interesting to consider.

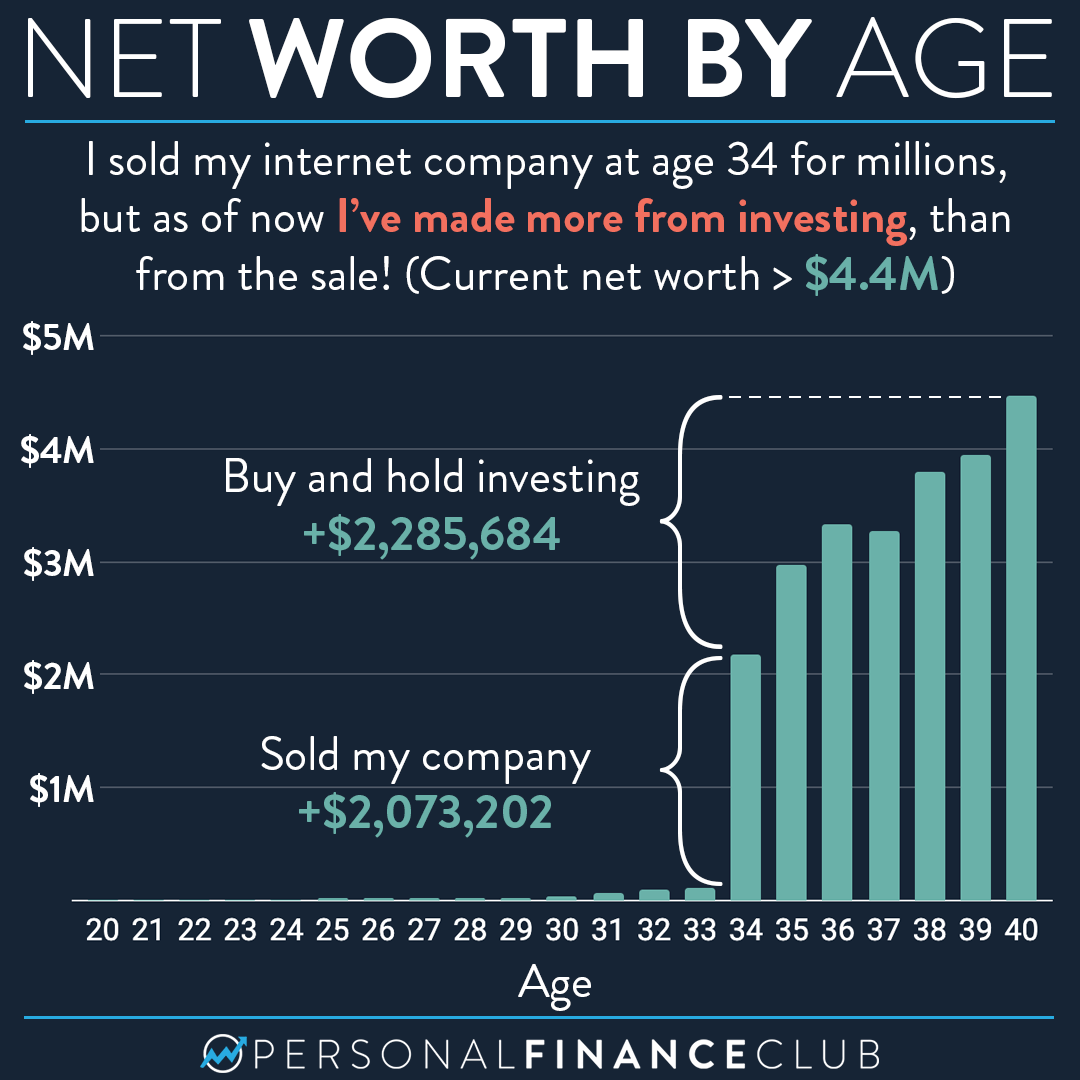

I’m a millionaire and this is my net worth by age – Personal Finance Club

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

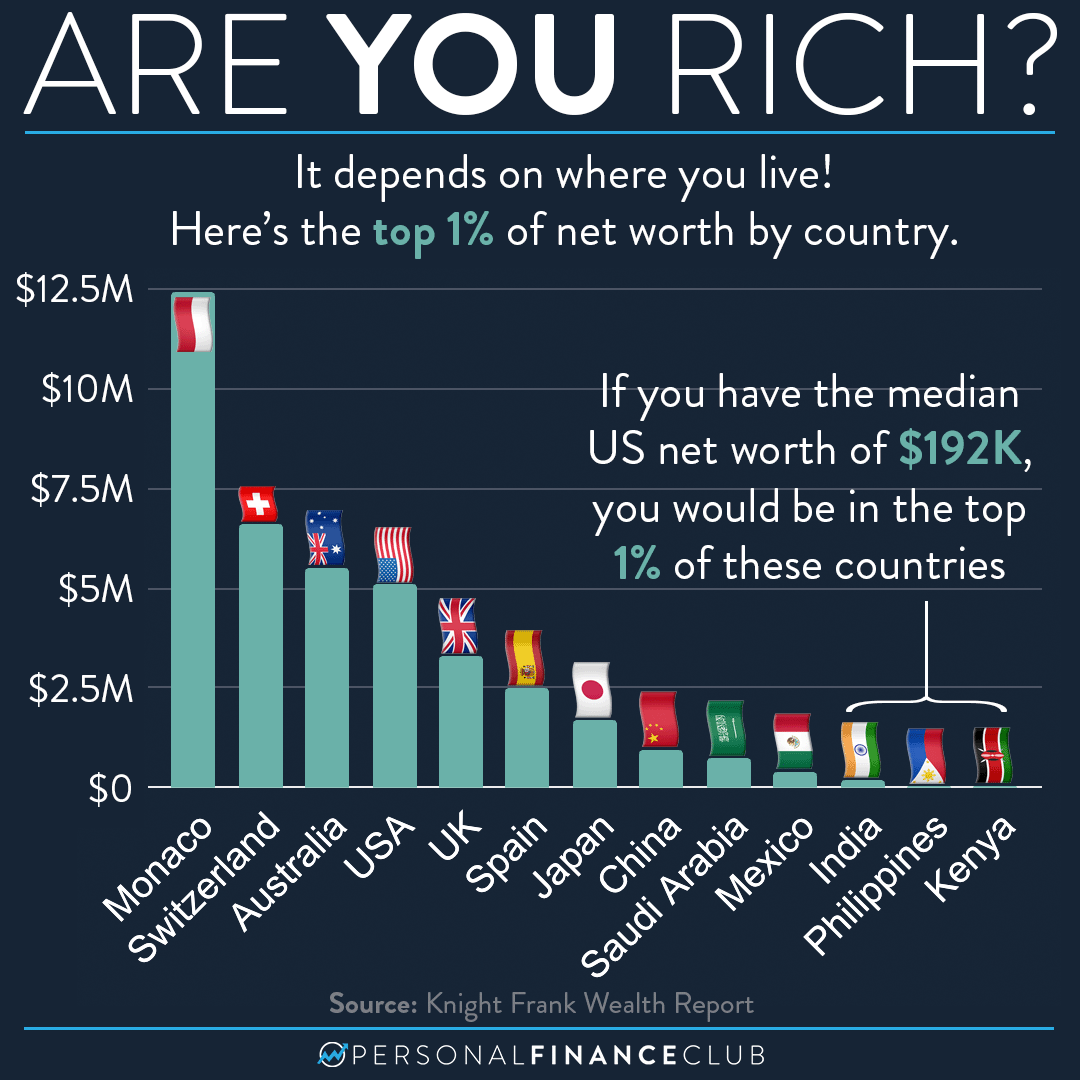

What is the top 1% of net worth by country? – Personal Finance Club