Top 0.1 Percent Net Worth - What It Means

When people talk about money and who has a lot of it, the conversation often goes to those at the very top. It is a topic that can spark a lot of thought and discussion, so it is quite interesting to consider. We hear about folks who have a great deal of wealth, and sometimes it feels like a very distant concept.

However, there is a particular group, a very small slice of the population, that holds a significant amount of the world's financial resources. This group is often called the "top 0.1 percent," and their financial standing is something many people wonder about. It is a designation that points to a level of prosperity that most individuals do not experience, and it is pretty fascinating to look at.

This article aims to shed some light on what being in this extremely well-off group truly means. We will explore how their wealth is measured, what sorts of things they might own, and some common ways people come to be part of this small collection of individuals. We will also touch on what their lives might be like and how their financial situations relate to the wider community.

Table of Contents

- What Does Being in the Top 0.1 Percent Net Worth Group Mean?

- How is Net Worth Calculated for the Top 0.1 Percent?

- What Kind of Assets Do They Typically Hold?

- Are There Common Paths to Joining the Top 0.1 Percent Net Worth?

- What Might Life Look Like for Those in the Top 0.1 Percent?

- Do Different Regions Have Different Top 0.1 Percent Net Worth Thresholds?

- Understanding the Impact of the Top 0.1 Percent Net Worth on Society

- Thinking About Wealth Beyond the Top 0.1 Percent

What Does Being in the Top 0.1 Percent Net Worth Group Mean?

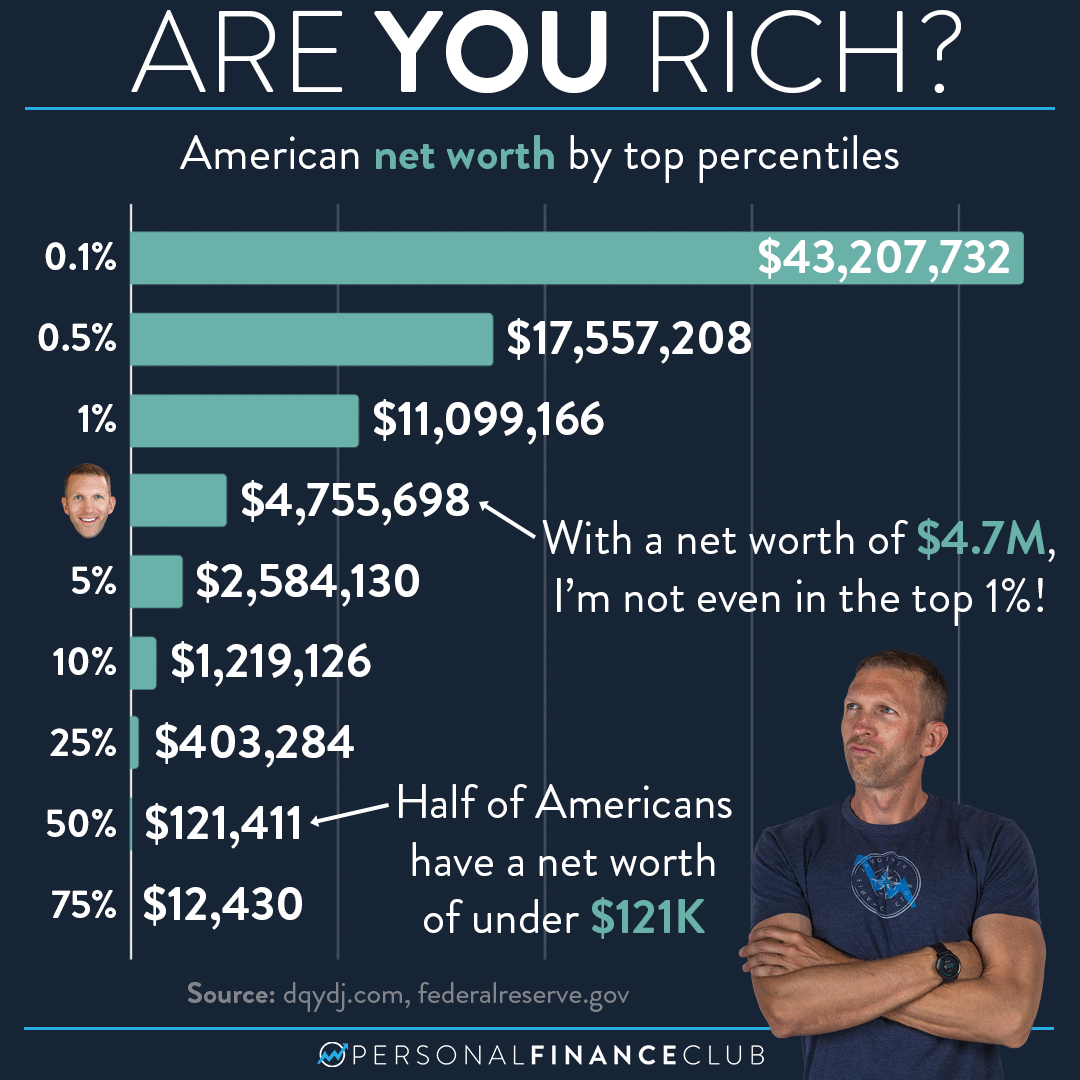

When we speak of the "top 0.1 percent net worth," we are talking about a very small fraction of all households or individuals in a particular country or even across the entire globe. This group possesses a collective financial value that is quite substantial, really. It means their total worth, after subtracting what they owe, places them at the very highest end of the economic ladder. To put it simply, for every thousand households, only one falls into this specific category, which is a rather tiny number.

The actual dollar figure needed to be part of this group changes over time and depends on where you are looking. What might qualify someone in one place might not in another, you know? It is not a fixed amount that stays the same year after year; it tends to increase as economies grow and as the value of various assets goes up. This threshold, the amount of money you need, moves around quite a bit.

It is also important to remember that this is about net worth, not just income. Someone could have a high income but also significant debts, meaning their net worth might not be as high as you would think. Conversely, someone with a lower income but many valuable assets and very little debt could have a much higher net worth. So, it is about the whole picture of what a person owns and what they owe, basically.

How is Net Worth Calculated for the Top 0.1 Percent?

Calculating net worth for anyone, including those in the top 0.1 percent net worth group, involves a pretty straightforward idea. You add up everything a person owns that has a monetary value. This collection of items is called their assets. Then, you subtract everything they owe, which are their liabilities. The result is their net worth, a figure that shows their overall financial standing. It is a bit like balancing a personal ledger, you see.

For people with significant wealth, their assets often include a wide array of things. This could mean ownership in businesses, stocks and bonds, valuable pieces of real estate, and even things like art collections or private jets. These items often have substantial market values, which really add up quickly. On the other side, their liabilities might include loans for property or other investments, but for this group, their assets usually far outweigh their debts, creating a very positive net worth.

The process of putting a value on these assets can be a little more involved for the very rich. For example, valuing a private company they own might require a detailed assessment, not just looking at a stock price. It is a more complex task than simply checking a bank balance, actually. Experts often come in to help determine the true market value of these less liquid, or harder to sell quickly, holdings.

What Kind of Assets Do They Typically Hold?

Individuals who find themselves in the top 0.1 percent net worth bracket usually hold a collection of assets that are quite different from what most people possess. Their financial holdings often go beyond simple savings accounts or a single home. They are more likely to have a substantial part of their wealth tied up in business ownership, which can include both publicly traded companies and private enterprises. This means they might own a significant chunk of a large corporation or be the sole proprietor of a very successful venture, you know.

Another common feature of their asset portfolio is a large amount of investment in financial markets. This includes shares in various companies, government bonds, and other forms of securities. They might also have substantial holdings in private equity funds or hedge funds, which are investment vehicles that typically require a large sum of money to join. These types of investments can offer considerable returns, helping their wealth to grow further, basically.

Real estate also plays a significant part in the wealth of this group. This is not just their primary residence, but often multiple properties, including vacation homes, investment properties, or commercial buildings. These properties can be located in various places around the world and often represent a very large portion of their total worth. It is a way for them to put their money into something that can hold its value or even go up over time, and stuff.

Beyond these common items, some individuals in the top 0.1 percent net worth group might own what are called "passion assets." These are things like rare art pieces, expensive collectibles, vintage cars, or even sports teams. While these items might not always be the most liquid, meaning easy to sell quickly, they can hold immense value and sometimes appreciate considerably. They are often enjoyed for their own sake, but also represent a significant part of someone's financial picture.

It is worth noting that the way these assets are managed is also a key difference. They often have teams of financial advisors, wealth managers, and legal experts helping them oversee their holdings. This is not a do-it-yourself kind of situation; it is a very professional operation, you see. They ensure their assets are structured in ways that are financially sound and that help preserve their wealth across generations.

Are There Common Paths to Joining the Top 0.1 Percent Net Worth?

People who reach the top 0.1 percent net worth status usually get there through a few main routes, though each individual story is quite unique. One very common way is through starting and building a highly successful business. This often involves creating something new, meeting a big need in the market, or simply doing something existing in a much better way. Think of the founders of large technology companies or those who built major industrial enterprises; they often start with an idea and grow it into something incredibly valuable, you know.

Another path is through high-level positions in established industries, particularly in finance, law, or medicine, where incomes can be very substantial over many years. While a high salary alone might not get someone into the very top tier, consistent saving, smart investing, and perhaps some entrepreneurial side ventures can certainly help. These individuals often earn a lot of money and are very good at making their money work for them over time, basically.

Inheritance also plays a role for some in the top 0.1 percent net worth group. Some individuals are born into families that already possess a great deal of wealth, and this wealth is passed down through generations. While they might not have built the initial fortune themselves, they are responsible for managing and often growing it. This can be a significant head start, to be honest.

For some, a combination of these paths might be the story. Someone might inherit some wealth, use it to start a business that then becomes very successful, and then invest the proceeds wisely. It is rarely just one single event that puts someone in this position; it is usually a series of smart choices, good fortune, and often a lot of hard work over many years. It is a pretty complex picture, actually.

Sometimes, the ability to spot opportunities others miss, or to take calculated risks that pay off big, also plays a part. This could be investing in an early-stage company that later becomes a household name, or buying property in an area before it becomes popular. These sorts of moves require foresight and a willingness to step out, and stuff.

What Might Life Look Like for Those in the Top 0.1 Percent?

Life for those in the top 0.1 percent net worth bracket can certainly appear quite different from the average person's experience. With substantial financial resources, they often have access to a wide range of goods and services that are simply out of reach for most. This can include private travel, multiple residences in desirable locations, and a staff to help manage their daily lives and properties. It is a level of convenience and comfort that is quite elevated, you know.

However, it is not always just about lavish spending. Many individuals in this group are also deeply involved in various philanthropic activities, donating large sums to charities, foundations, and social causes. They might establish their own charitable organizations or contribute to existing ones, seeking to make a positive impact on the world with their resources. This aspect of their lives is often less visible but can be a very significant part of what they do, basically.

Their professional lives often continue to be very active, even if they have achieved great wealth. Many continue to lead businesses, serve on boards, or pursue new ventures. For them, work might not just be about earning money, but about pursuing passions, solving big problems, or simply staying engaged and productive. It is a drive that often goes beyond financial gain, really.

Social circles for the top 0.1 percent net worth individuals can also be somewhat distinct. They might interact with other high-net-worth individuals, business leaders, and influential figures from various fields. Their children might attend exclusive schools and universities, and their social activities might include high-profile events or private gatherings. This can create a somewhat closed environment, in a way.

It is also worth considering that managing such vast wealth comes with its own set of responsibilities and challenges. There are complex financial decisions, tax considerations, and the need to plan for future generations. It is not just about having money; it is about managing it effectively and preserving it. This can be a full-time job in itself, to be honest.

Do Different Regions Have Different Top 0.1 Percent Net Worth Thresholds?

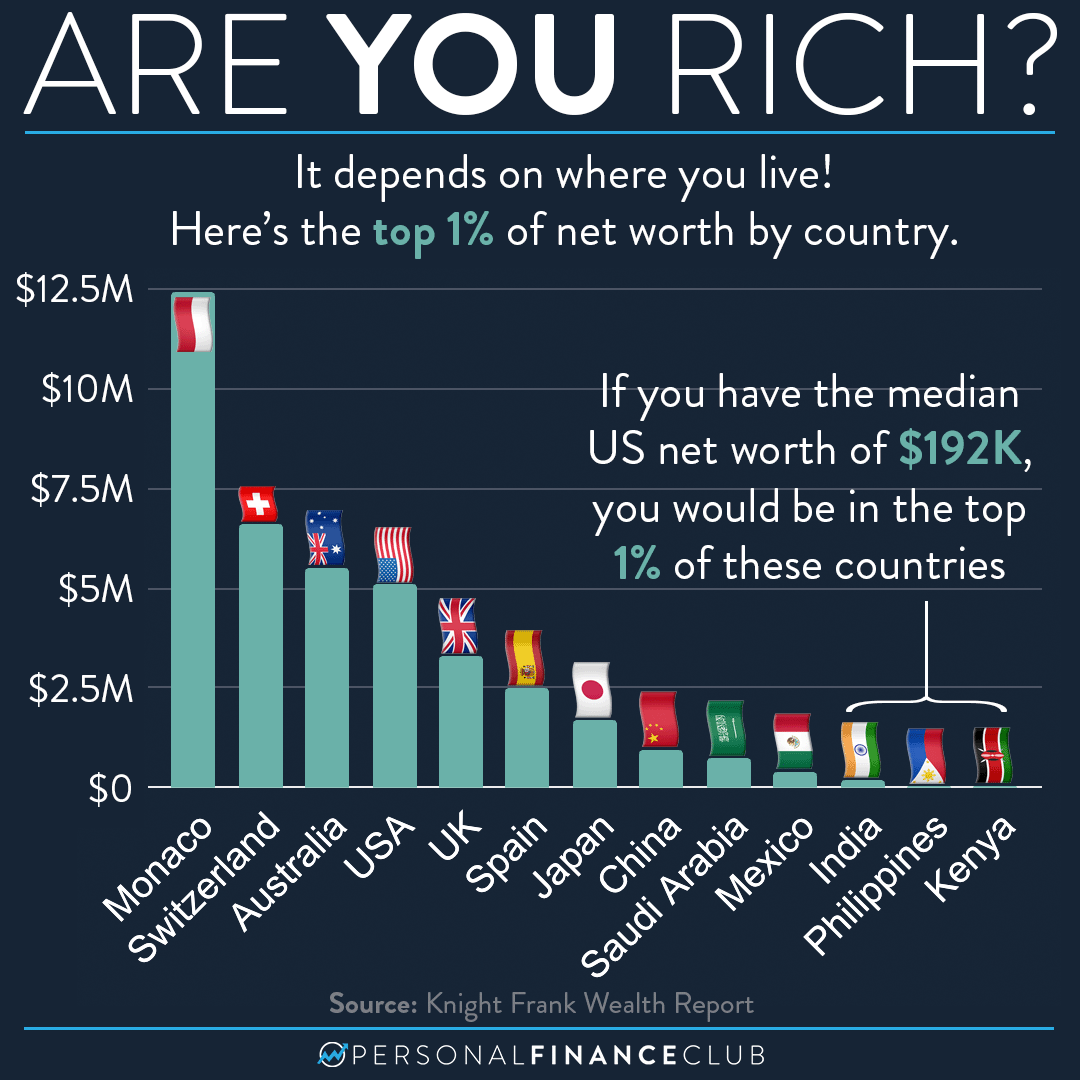

Yes, absolutely. The amount of net worth needed to be in the top 0.1 percent net worth group varies quite a bit depending on the specific country or region you are looking at. What is considered very wealthy in one place might be less so in another, or perhaps just average, you see. This is because economic conditions, cost of living, and the overall distribution of wealth are not the same everywhere on the globe.

For instance, in countries with highly developed economies and established financial markets, the threshold for joining this elite group tends to be much higher. Places like the United States, Switzerland, or certain parts of Asia might require tens of millions of dollars, or even more, in net worth to be considered part of the top 0.1 percent. These places often have a long history of capital accumulation and a large number of very wealthy individuals, basically.

Conversely, in countries with developing economies or lower average incomes, the net worth figure required to be in the top 0.1 percent could be considerably lower. While still representing a significant amount of wealth within that specific country, it might not translate to the same level of global purchasing power. So, the context of the local economy is very important when looking at these figures, really.

These differences mean that someone who is considered extremely wealthy in one nation might not even make it into the top one percent in another. It is a relative measure, reflecting the economic landscape of a particular area. So, when you hear about the top 0.1 percent net worth, it is always helpful to consider the geographic location being discussed, you know.

Understanding the Impact of the Top 0.1 Percent Net Worth on Society

The existence of a top 0.1 percent net worth group has a pretty big impact on society as a whole. Their substantial financial holdings and influence can shape various aspects of public life, from economic policies to cultural trends. Their investment decisions can affect job creation, market stability, and the direction of innovation. When they put their money into certain industries or ventures, it can lead to growth and change in those areas, basically.

There are often discussions about wealth concentration and what it means for fairness and opportunity. Some people believe that a high degree of wealth held by a very small number of individuals can lead to imbalances, where a few have too much power or influence. Others might argue that this wealth is a result of innovation and risk-taking, and that it

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

What is the top 1% of net worth by country? – Personal Finance Club

The Top One Percent’s Net Worth Is Astonishing